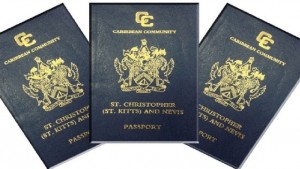

BASSETERRE, ST. KITTS, MAY 30th, 2016 (PRESS SEC) – The Team Unity administration today Monday 30 May revoked the passports for Nevada US resident attorney Mr. David B. Kaplan and his wife Lisa M. Kaplan, who are both named in a recent U.S. S.E.C. filing.

The US Securities and Exchange says it has filed fraud charges against David Kaplan based on an allegedly fraudulent scheme that raised $15.8 million, out of which approximately $385,000 was sent to St Kitts and Nevis, and of which at least $79,394 was wired to a St Kitts law firm to obtain passports and/or St Kitts and Nevis citizenship for Kaplan and his wife.

In U.S. Securities and Exchange Commission v. David B. Kaplan, Esq., et al., Civil Action No. 3:16-cv-00270 (D. Nevada-Reno filed May 19, 2016), the S.E.C. announced that it has obtained an asset freeze against attorney and Nevada resident David B. Kaplan. Mr. Kaplan is accused of misrepresenting investments and misappropriating investor funds.

The SEC complaint, unsealed on Friday, was filed on May 19, 2016, in the US District Court for the District of Nevada-Reno, and charges Kaplan and three entities, Synchronized Organizational Solutions International Ltd, Synchronized Organizational Solutions LLC, and Manna International Enterprises Ltd.

.

According to the complaint, Kaplan repeatedly lied to prospective investors by stating that their funds would be invested in a low-risk, private offshore trading program that would be provide estimated monthly profits of 10 percent. The complaint alleges that Kaplan did not use investor funds as promised but instead:

• Used at least $2.3 million for his personal benefit, including approximately $385,000 sent to St Kitts and Nevis between June 2015 to March 2016, of which at least $79,394 was wired to a St Kitts law firm to obtain passports and/or St Kitts and Nevis citizenship for Kaplan and his wife;

• Sent $1.1 million to his wife, Lisa Kaplan, a purported charitable foundation, and a corporation that Kaplan controlled;

• Invested at least $360,000 in an allegedly fraudulent scheme at the centre of a federal criminal indictment in Ohio; and

• Made approximately $1.8 million in Ponzi-like payments to other investors.

On May 20, 2016, the court issued a temporary restraining order freezing the assets of Kaplan and the other defendant entities, and prohibiting them from soliciting, accepting or depositing any monies from actual or prospective investors while the order is in effect. The order further requires Kaplan and the defendants to repatriate foreign assets within seven days.

The SEC brought its emergency enforcement action to ensure that no further securities law violations are committed, to secure assets from potential dissipation, and to safeguard investors from further harm. The SEC’s complaint seeks to have Kaplan, his firms, and the other defendants return their allegedly ill-gotten gains so that any remaining funds can be returned to victims of the alleged scheme.

The case is Securities and Exchange Commission v. David B. Kaplan, Esq., et al., Civil Action No. 3:16-cv-00270 (D. Nevada-Reno filed May 19, 2016) It is alleged that some of these funds were wired to a St. Kitts law firm, to assist them in attaining St. Kitts and Nevis citizenship.

The Kaplans’ application was processed after appropriate due diligence checks by a highly reputable, internationally renowned due diligence service provider, employed by the TUG, found no evidence of impropriety or illegal activity. Based on the filing by the U.S. Security Exchange Commission, which was released on May 27th, 2016, the Government of St. Kitts and Nevis has decided to revoke the passports with immediate effect.